100+ customers benefit from Azdan's assistance in implementing NetSuite ERP to streamline business processes

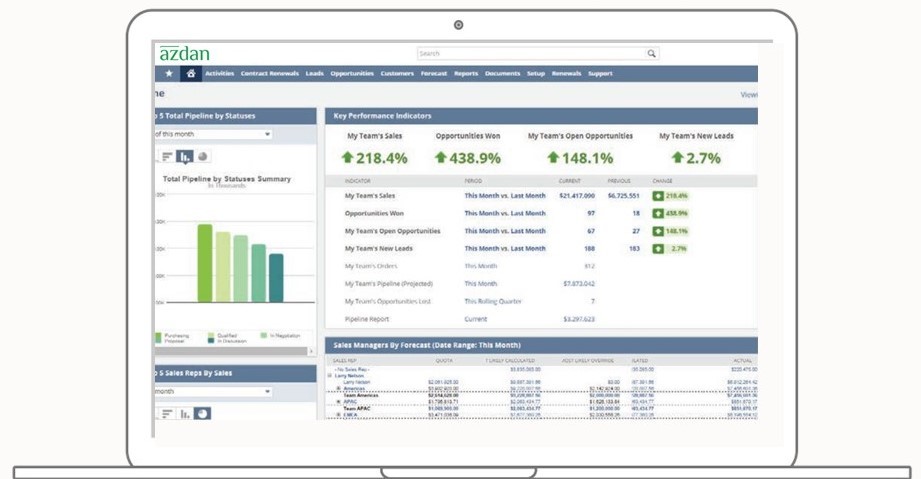

Implement The World's Leading Cloud ERP Solution for Smarter Decision-Making

Oracle NetSuite ERP will help your company become more self-aware by linking information about production, finance, distribution, and human resources together.

NetSuite Financials

It can efficiently handle and track financial transactions, automate core accounting processes, and generate accurate financial reports.

- Transaction management

- Advanced billing engine

- Planning and Budgeting

- Revenue Recognition

- Financial Reporting

- Fixed Assets

- Automated process

Financial Consolidation

It helps in streamlining financial close and consolidation while addressing complex global accounting and reporting requirements

- Chart of accounts and rules

- Realtime Dashboards

- Approval Automation

- Data consolidation

- Error reduction

- Standardization

- Automated processes

- Real-time reporting

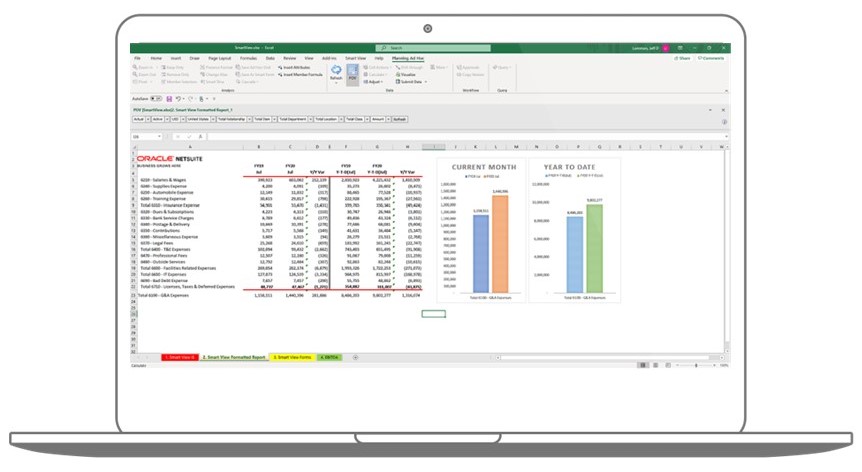

Planning & Budgeting

It enables businesses to create, manage, and track budgets effectively. It facilitates collaboration among stakeholders, an supports financial planning.

- Budget Variance Analysis

- Forecasting

- Capital Expenditure Planning

- Rolling Forecasts

- Driver-Based Planning

- Scenario Analysis

Global Accounting

It addresses the complexities of international accounting. It facilitates multi-currency transactions and foreign exchange management.

- Multi-currency support

- Holistic financial view

- Intercompany Transactions

- Multi-Language Support

- Statutory Compliance

- Currency Translation

- Legal Entity Management

VAT Reporting

NetSuite simplifies Value Added Tax (VAT) reporting through automated calculations and streamlined processes.

- VAT Compliance Monitoring

- VAT Reconciliation

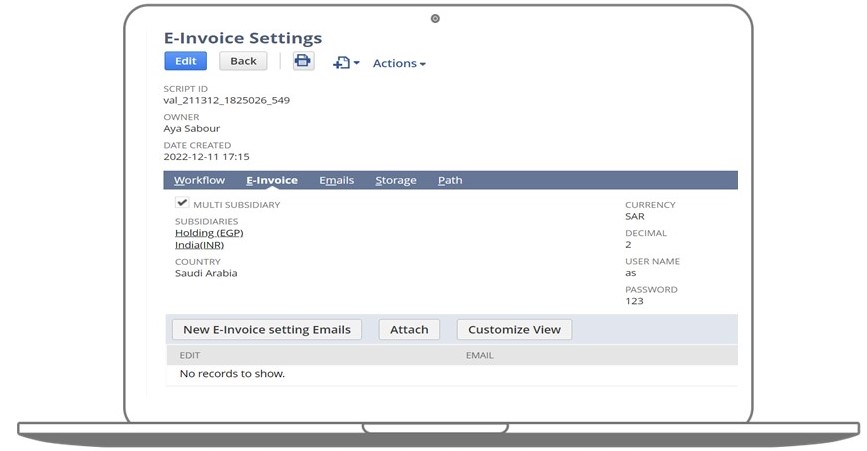

- Electronic VAT Filing

- VAT Calculation Automation

- VAT Exemption Handling

- Compliance with regulations

- Accurate reporting

Check How Foodics Boosted Their Performance by 3x Across Different Regions and Achieved Significant Business Scalability

Oracle NetSuite

In this NetSuite ERP guide, you'll find a documentation, offering users valuable instructions to leverage the features of NetSuite ERP.