Cash and Liquidity Management

THE LARGEST IMPLEMENTATION TEAM IN THE MIDDLE EAST

Get 100% cash visibility, eliminate manual processes, No matter your number of banks!

Why you have to automate your cash management process?

Having clarity and visibility into cash and liquidity is a fundamental requirement for any treasury department. Without that, it is nearly impossible to support critical financial decisions and strategic business objectives. That’s why Kyriba leverages industry-best bank connectivity, enabling you to get cash positions from every global bank at the start of each day.

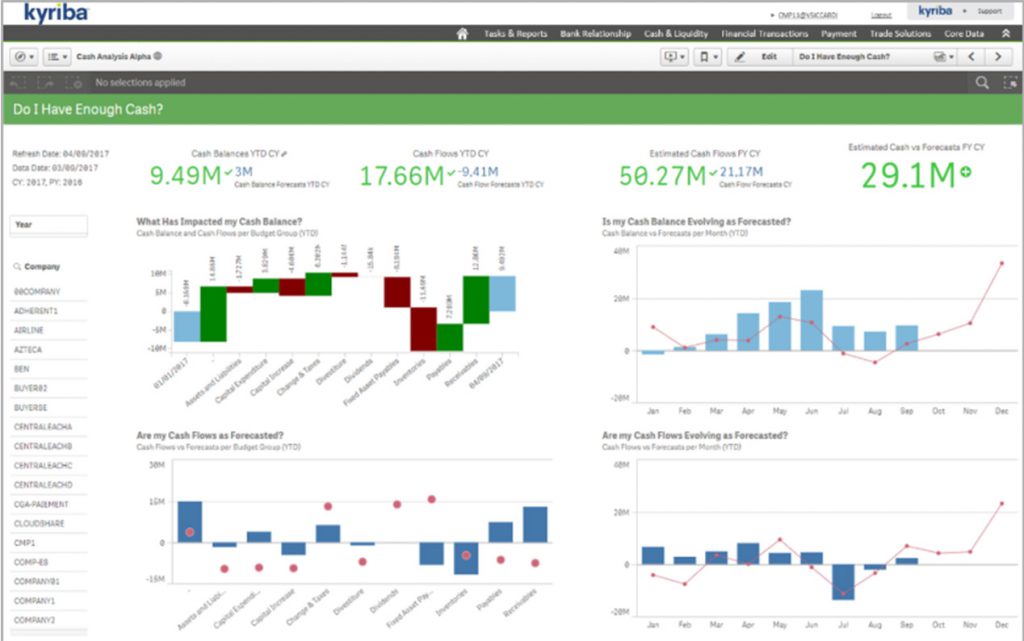

Kyriba delivers timely and accurate global cash visibility, enabling treasury teams to create accurate forecasts that deliver confidence throughout the organization. Kyriba’s advanced cash forecasting capabilities are unparalleled with extensive options for entry, import, modeling and measuring the effectiveness of cash forecasts.

Cash and Liquidity management Capabilities

Dynamic Reporting

Personalized cash position worksheets and period-based views provide the summary of balances and their evolution over time, while the daily view provides a categorized summary of the actual and forecasted cash movements of the day.

Global Positioning

Cash position can be viewed by region and/or by currency. Foreign currencies can be viewed based upon exchange rates or positions can be viewed in their native currency.

Liquidity

Analyze total liquidity by incorporating desired investment and credit data from the Debt and Investment modules. A dedicated liquidity report aggregates and sums data in worksheet, graphical or interactive map forms.

Multi-Entity

View position by individual entity, or analyze corporate-wide cash position configurable to each client’s requirements. Full drill-down allows viewing the summary as well as supporting detail.

Seamless Integration

The cash position is updated continuously in real-time, so any changes made to a forecast – including from other Kyriba modules – will be automatically available on a client’s worksheet(s).

Target Balances

Cash pooling allows target balances to be set in a hierarchical manner, ensuring that recommended funding and drawdowns are predicted, and can automatically occur in combination with the Kyriba Payments solution.

The platforms we use create value for our clients

Whether you choose a simpler first phase to get profits quickly or you opt for full deployment, you are in the right place!

Kyriba Cash Management

Kyriba pioneered cloud treasury and finance, Kyriba offers world-class connectivity options for bank statement reporting, payments, ERPs, trading portals, and cloud platforms

FAQ

Most frequent questions and answers

Yes, you can acquire your user licenses directly from Azdan. Azdan as a solution provider can deliver complete cloud computing solutions, from selling NetSuite licenses to implementation and support.

Many vendors have very well-established product lines. We are not biased to any of them. We are only considering delivery critical factors such as solution functionality based on your vertical industry needs.

The implementation time frame vary according to the project size. the average duration is 3 months for small to medium projects. and 4 to 6 months for large implementations.

Yes, we can travel to visit your team onsite incase you need to discuss your project in details. However, If you need to speed up the process, we are excited to have an online remote session first.

Azdan has 4 global offices in UK, UAE, Egypt, and Rwanda. These global offices are serving 20+ countries that are not limited to KSA, Kuwait, Bahrain, Oman, Bahrain, Jordan, Lebanon, Rwanda, Egypt, UK, and UAE.

The Implementation price vary according to your specific needs and requirements. Feel free to contact our sales team here to receive a budgetary quotation.